Hey there, credit card enthusiasts! Ready to find the perfect companion for your wallet in 2025? Whether you’re a travel junkie ✈️, a shopping addict 🛍️, or just love cashback 💸, we’ve got you covered with the Top 10 Credit Cards in India as of April 1st, 2025. From luxe perks to everyday savings, these cards are the cream of the crop! Let’s dive in with dazzling details, annual fees, return rates, and who they’re best for—complete with eligibility deets. Grab your coffee ☕ and let’s roll!

Check out all the Top Credit Cards in India for 2025 and Apply Here.

10. Swiggy HDFC Credit Card 🍔

RPC Rating - 4.0/5 🌟

Annual Fee: ₹500 + Taxes (often LTF offers)

Joining Benefits: 3-month Swiggy One membership 🎉

Return Rate: Up to 10% (10% on Swiggy, 5% on 1000+ merchants, 1% elsewhere)

Perks & Benefits:

10% off on Swiggy / Instamart / Dineout orders 🍕

1% fuel surcharge waiver ⛽

Rs.1500 cashback cap on Swiggy cashback, means you can spend upto 15,000/month. 🚀

5% cashback on 1000+ other merchants like Amazon / Flipkart / Myntra / Nykaa / Uber, and many more, capped at Rs.1,500/m cashback.

Best For: Quick Commerce and Food delivery fans

Recommended Spend: ₹1-3 lakh/year

Salary Range: ₹25,000-50,000/month

Eligibility: ₹3 lakh annual income, 650+ credit score

💡 Why It’s Tasty: Cheap, cheerful, and a Swiggy lover’s dream—order in and save big!

Check out all the Top Credit Cards in India for 2025 and Apply Here.

9. SBI Cashback Credit Card 💸

RPC Rating - 4.1/5 🌟

Annual Fee: ₹999 + Taxes (waived on ₹2 lakh spend)

Joining Benefits: NA

Return Rate: Up to 5% (5% online, 1% offline)

Perks & Benefits:

1% fuel surcharge waiver ⛽

No merchant restrictions on cashback 🌐

Best For: Online shoppers

Recommended Spend: ₹3-6 lakh/year

Salary Range: ₹30,000-75,000/month

Eligibility: ₹3 lakh annual income, 650+ credit score

💡 Why It Pays: Simple, no-fuss cashback for everyday spends—perfect for beginners!

Check out all the Top Credit Cards in India for 2025 and Apply Here.

8. HDFC Tata Neu Infinity Credit Card 🛒

RPC Rating - 4.1/5 🌟

Annual Fee: ₹1,499 + Taxes (Or first year free if you use the link below to apply)

Return Rate: Up to 10% (5% NeuCoins on Tata brands + 5% on using Tata Neu App & 1.5% on Tata Neu UPI)

Perks & Benefits:

4 international & 8 domestic lounge visits/year 🛋️

2% forex markup fee 💵

Extra NeuCoin offers on Tata Neu app 🛍️

Best For: Tata ecosystem shoppers, and utility payments

Recommended Spend: ₹3-5 lakh/year

Salary Range: ₹50,000-1 lakh/month

Eligibility: ₹6 lakh annual income, 700+ credit score

💡 Why It’s Neat: Affordable with awesome returns for BigBasket, 1mg, Air India / Taj / Croma / Westide and overall Tata loyalists!

Check out all the Top Credit Cards in India for 2025 and Apply Here.

7. Amex Platinum Travel Credit Card 🌴

RPC Rating - 4.2/5 🌟

Annual Fee: ₹5,000 + Taxes

Joining Benefits: 10,000 MR Points

Base Return Rate: 7-8% returns if points are used for economy flight redemptions.

Accelerated Return Rate: Up to 30% returns if maximised effectively, converted to Marriott, using transfer bonus & 4+1 Marriott offer (Between 48,000 - 60,000 points every year)

Perks & Benefits:

8 lounge visits/year (domestic) 🛋️

₹10,000 Taj voucher on ₹4 lakh spend 🎁

Milestone rewards up to 40,000 points 🚀

Best For: Marriott Hotel Lovers.

Recommended Spend: ₹4 lakh/year

Salary Range: ₹75,000-1 lakh/month

Eligibility: ₹6 lakh annual income, 700+ credit score

💡 Why It’s Cool: Entry-level luxury with solid travel rewards—perfect for occasional explorers!

6. HDFC Diners Club Black (DCB) Metal Credit Card ⚡

RPC Rating - 4.1/5 🌟

Annual Fee: ₹10,000 + Taxes (Waived on spending 1.5L in 90 days)

Renewal Fee Waiver : 8L Spend in Previous Year

Joining Benefits: Amazon Prime, Swiggy One, Club Marriott memberships 🎊

Return Rate: Up to 3.33% (10 points/₹300; 1 point = ₹1 for travel)

Accelerated Return Rate: 9.9% on vouchers (3x) / 16.5% on flights (5x) / 33% on Hotels (10x) [Capped at 10,000 points per month]

Milestone benefits - Get an extra 10,000 RP on spending 4L per quarter.

Perks & Benefits:

Unlimited lounge access worldwide 🛋️

10,000 bonus points on ₹4 lakh quarterly spend 🎯

2% forex markup fee 🌍

Best For: Travel buffs and for excluded spend criteria like rent and govt expenses with the milestone benefits.

Recommended Spend: ₹8-16 Lakhs/year

Salary Range: ₹2.5 lakh/month+

Eligibility: ₹2.5 lakh/month income, 750+ credit score

💡 Why It’s Fab: Slightly cheaper than Infinia but packs a punch with similar perks—great for those who can’t snag the invite-only king!

5. Axis Atlas Credit Card ✈️

RPC Rating - 4.3/5 🌟

Annual Fee: ₹5,000 + Taxes

Joining Benefits: 2,500 EDGE Miles 🎁

Return Rate: 5.3% (2 EDGE Miles/₹100 on regular expenses; 1 mile ≈ 2 partner points + Milestone points)

Accelerated Return rate: 10 - 11.33% earned on Travel (Book flights and Hotels on direct airline and hotel sites for 5 EM / Rs.100). Can skyrocket to 20% returns if points are transferred to Accor.

Perks & Benefits:

Upto 16 domestic & 12 international lounge visits/year 🛋️

Up to 10,000 milestone EDGE Miles 🚀

Best For: Frequent flyers

Recommended Spend: ₹7.5-1.5 lakh/year

Salary Range: ₹1.5 - 3 lakh/month

Eligibility: ₹12 lakh annual income, 700+ credit score

💡 Why It Soars: Affordable yet travel-focused—ideal for those who want miles without breaking the bank! (Best Return Rates when transferred to Accor)

Check out all the Top Credit Cards in India for 2025 and Apply Here.

4. ICICI Times Black Credit Card 🎬

RPC Rating - 4.4/5 🌟

Annual Fee: ₹20,000 + Taxes

Joining Benefits: – 10,000 INR Easemytrip Hotel Voucher + 3,000 INR Tony & Guy Salon Voucher

Return Rate: 2% Base Returns

Accelerated Return Rate: 12% on vouchers (6x) / 12% on flights (6x) / 24% on Hotels (12x) [Capped at 15,000 accelerated points per month]

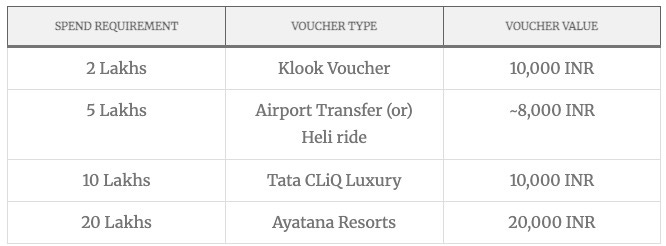

Perks, Benefits, and Milestones:

Low 1.5% forex markup fee & 2.5% Return rate.💱

Milestones -

Best For: Luxury Lovers and people who want convenience.

Recommended Spend: ₹20L a year

Salary Range: ₹1.5-2 lakh/month

Eligibility: ₹20 lakh ITR or ₹1.5 lakh/month salary

💡 Why It Pops: Luxury meets functionality - best card for those who enjoy the finer things in life.

3. HDFC Infinia Credit Card 🌟

RPC Rating - 4.6/5 🌟

Annual Fee: ₹12,500 + Taxes

Joining Benefits: 12,500 reward points + Club Marriott membership 🎁

Return Rate: Up to 3.33% (5 points/₹150; 1 point = ₹1 on flights/hotels via SmartBuy)

Accelerated Return Rate: 16.5% on vouchers (3x) / 16.5% on flights (5x) / 33% on Hotels (10x) [Capped at 15,000 accelerated points per month]

Perks & Benefits:

Unlimited domestic & international lounge access 🌍

10X points on SmartBuy (travel/shopping) 🚀

Low 2% forex markup fee 💱

Complimentary golf games ⛳

Best For: High spenders & frequent travelers

Recommended Spend: ₹10-15 Lakhs/year

Salary Range: ₹5 lakh/month+

Eligibility: Invite-only; high credit score (750+), existing HDFC relationship (5L monthly net Salary, or 8L Existing limit on HDFC Card with 8L+ spend in the last 6months)

💡 Why It Rocks: The king of premium cards, Infinia offers insane value for big spenders. If you’re jetting off or shopping online often, this is your VIP pass!

2. Axis Magnus Burgundy Credit Card 🔥

RPC Rating - 4.7/5 🌟

Annual Fee: ₹30,000 + Taxes

Joining Benefits: ₹10,000 Tata CLiQ voucher.

Return Rate: 4.8% (12 points/₹200; transferred at 5:4 (80%) ratio to partners)

Accelerated Return Rate - 14% Return Rate on spends >1.5L per calendar month (35 points/₹200)

Perks & Benefits:

Unlimited lounge access (domestic & international) 🛋️

Great transfer ratios to Accor, and flexible with 15+ partners.

Get points on Rental transactions upto Rs.50,000 per month.

Best For: Luxury & Travel lovers with Axis Burgundy accounts

Recommended Spend: ₹30 lakh/year

Salary Range: ₹3-10 lakh/month

Eligibility: Axis Burgundy account (₹10 lakh AMB) or 3L Monthly Net Salary.

💡 Why It’s Hot: Post-devaluation, it’s still a gem for Burgundy users with travel perks galore. Pair it with high spends for max value!

1. ICICI Emeralde Private Metal Credit Card 💎

RPC Rating - 4.9/5 🌟

Annual Fee: ₹12,500 + Taxes

Joining Benefits: 12,500 reward points + Taj Epicure membership 🎈

Return Rate: 6 points/₹200 ; 1 point = ₹1 | 3% (3.7% if you hit milestone)

Accelerated Return Rate: 18% on vouchers (6x) / 18% on flights (6x) / 36% on Hotels (12x) [Capped at 21,000 accelerated points per month]

Milestone 1 - Spend 4L and get a Rs.3,000 EaseMyTrip Voucher (0.75% Return Rate).

Milestone 2 - Spend 8L and get a Rs.3,000 EaseMyTrip Voucher (0.75% Return Rate).

Perks & Benefits:

Unlimited domestic & international lounge access

Foreign Currency Markup Fee: 2%+GST = 2.36%

Free golf rounds 🏌️♂️

Best For: Globetrotters & Shoppers.

Recommended Spend: ₹15-25L

Salary Range: ₹3 lakh/month+

Eligibility: Invite-only; 3L+ Monthly net salary or high existing TRV & Relationship with ICICI Bank.

💡 Why It Shines: A travel beast with high accelerated cappings and easy an easy to redeem iShop Portal.

How We Picked These Champs 🏆

We’ve ranked these cards based on return rates (how much you earn back), annual fees (value for money), versatility, and perks (lifestyle fit). From luxe travel cards like Infinia, EPM, and Times Black, to everyday winners like SBI Cashback and Swiggy HDFC, there’s something for everyone!

Which Card Suits You? 🤔

Best Return Rates: Axis Atlas, ICICI Emeralde ✈️

Luxury Seekers: Axis Magnus Burgundy, ICICI Times Black 💎

Shopaholics: HDFC Tata Neu Infinity, SBI Cashback 🛍️

Foodies: Swiggy HDFC

Allrounders : Amex Platinum Travel, HDFC Infinia / DCB

Check out all the Top Credit Cards in India for 2025 and Apply Here.

Final Takeaway 🌈

Your perfect card depends on your vibe—spending big or saving smart? Check bank websites for the latest T&Cs, as perks can shift. Got a fave from this list? Drop your thoughts below—we’d love to hear! Happy swiping in 2025! 💳🎉

Check out all the Top Credit Cards in India for 2025 and Apply Here.