Unlock Triple Rewards: The Complete Guide to the American Express Trifecta in India 🚀💸

Here's how you earn over 100k Amex Points & optimally use them by spending less than 60k/m

Do you feel like your credit card rewards are a bit… well, flat? What if you could supercharge those points and make every swipe work harder for you? Enter the Amex Trifecta—a clever combo of three powerful American Express cards designed to maximize your returns. If you've been looking to squeeze every drop of value from your expenses, buckle up—we're about to take a deep dive into how you can turbocharge your rewards game!

The Power of the Amex Trifecta: What Is It?

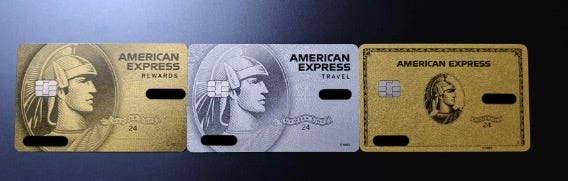

The Amex Trifecta is the magic formula for those who love optimizing their credit card rewards. By strategically combining the Amex Membership Rewards Credit Card (MRCC), the Amex Platinum Travel Credit Card, and the Amex Gold Charge Card, you can unlock incredible rewards, travel perks, and substantial cashback value.

But don't just take our word for it—let's break down exactly how each card contributes to the trio and why this combination is considered one of the best strategies for high-spending individuals.

Meet the All-Star Trio 🏆

Here’s how each card contributes to your rewards strategy:

1. Amex Membership Rewards Credit Card (MRCC) 🎁

Yearly Spend: ₹2,40,000

Joining Fee: ₹1,000

Welcome Bonus: 4,000 MR points on spending ₹15,000 within 90 days.

Milestone Rewards:

1,000 MR points on spending ₹20,000 per month.

An additional 1,000 MR points on spending ₹1,500 plus on 4 transactions every month.

Standard Earn Rate: 1 MR point per ₹50 spent.

Yearly Points Accrued: 28,800 MR points (Write off joining fee with joining bonus)

The Strategy: Use this card for smaller, recurring payments to hit your monthly transaction targets. Think of it as your go-to card for routine expenses like groceries, utility bills, or even that daily coffee run ☕.

2. Amex Platinum Travel Credit Card ✈️

Yearly Spend: ₹4,00,000

Joining Fee: ₹3,500

Welcome Bonus: 10,000 MR points on the first spend of ₹5,000 within 90 days.

Milestone Benefits:

15,000 points at ₹1.9 lakh spend

25,000 points on spending ₹4 lakh

Standard Earn Rate: 1 MR point per ₹50 spent.

Yearly Points Accrued: 48,000 MR points

The Strategy: Use this card for all high-value transactions, especially travel and big-ticket purchases.

3. Amex Gold Charge Card 🌟

Yearly Spend: ₹72,000

Joining Fee: ₹1,000

Welcome Bonus: 4,000 MR points on spending ₹15,000 within 90 days.

Monthly Bonus: Earn 1,000 points by making 6 transactions of ₹1,000 each month.

Accelerated Reward Rate: Additional 7,200 points from 5x multipliers through Gyftr transactions.

Standard Earn Rate: 1 MR point per ₹50 spent & 5MR Points per ₹50 spent on Amex Gyftr

Yearly Points Accrued: 23,200 MR points

The Strategy: Use this card for moderate, frequent expenses—think of dining out, entertainment, and subscriptions. It’s your “set it and forget it” card for racking up points efficiently. Use this on Amex Gyftr for 5x.

The Grand Total: A Year of Optimized Spending 💎

A yearly spend of ₹7,12,000 across the three cards, here’s the breakdown:

Card

Total Points Accrued

Amex MRCC - 28,800 + 4,000 joining = 32,800

Amex Platinum Travel 48,000 + 10,000 joining = 58,000

Amex Gold Charge 23,200 + 4,000 joining = 27,200

Grand Total

118,000 MR Points

Total Annual Spend: ₹7,12,000

Annual Fees: ₹1,000 (MRCC) + ₹3,500 (Platinum Travel) + ₹1,000 (Gold Charge) = ₹5,500

Valuation Breakdown

Points Worth: ₹0.50 to ₹1 per point

Estimated Value: ₹65,000 to ₹1,30,000 (depending on how you redeem your points)

With a total value earned back between 8.5% to 17%, this strategy is a real game-changer for anyone looking to maximize their returns.

How to Redeem and Optimize Your Rewards 🛍️💸

The key to getting the most value from your points lies in strategic redemption:

Travel Vouchers: The Platinum Travel Card offers Taj gift cards worth up to ₹29,500—perfect for offsetting your next holiday expenses. or transfer them to Marriott at 1:1 for maximum value.

Statement Credits: Redeem your points for statement credits, especially if you value flexibility. This typically offers ₹0.25 per point (Not recommended)

High-Value Purchases: Consider redeeming points for exclusive Amex partner deals to get more bang for your buck.

Pro Tips to Keep the Rewards Flowing 🚀

Consistency is Key: Make sure to hit your transaction targets on the MRCC and Gold Charge cards every month to earn those easy bonus points.

Referrals for Extra Points: Don’t overlook the potential of referrals—16,000 points just for getting friends or family to join can add a significant boost to your total.

Monitor Spending Milestones: Keep an eye on your Platinum Travel Card spend to ensure you hit the ₹4 lakh mark. Missing out on those milestone rewards would be like leaving money on the table!

Leverage Amex Offers: Regularly check your Amex app for offers that can help you earn extra points or cashback on dining, travel, and shopping.

The Final Lap: Is the Amex Trifecta Right for You?

The Amex Trifecta is like having three power-packed engines revving up your rewards. If you can align your spending habits with the milestones, you could see a substantial return on your everyday expenses.

So, are you ready to make every swipe count and fuel up on rewards? 🚀💳 Whether it's redeeming for luxurious travel or pocketing cash savings, the Amex Trifecta is here to make your money work harder for you.

Use the link below to get your Amex Trifecta Cards and get additional rewards as well

MRCC - Fee - Rs.1,000 - Joining Bonus - 4,000 Amex Points & Rs.500 Amazon Voucher

Plat Travel - Fee - Rs.3,500 - Joining Bonus - 10,000 Amex Points & a Rs.1,000 Amazon Voucher

Amex Gold Card - Fee - Rs.1,000 (First year) - Joining Bonus - 4,000 Amex Points & a Rs.500 Amazon Voucher.

This works for the first year but what about when the renewal fee increases for all the cards. Is it worth it then?

Use this link to get referral bonus

https://www.americanexpress.com/en-in/credit-cards/referral/prospect/cards/intl/aNUSHSHxH7?CORID=a~N~U~S~H~S~H~x~H~7-1730107201733-184623954&CPID=100364208&GENCODE=349993268636251&XL=MIMNS&ref=aNUSHSHxH7&v=2