Updates to the Platinum Charge Card - Lets look at the positives.

With the negative news of the Platinum charge price hike, let's look at some of the benefits and see if this card is still worth it.

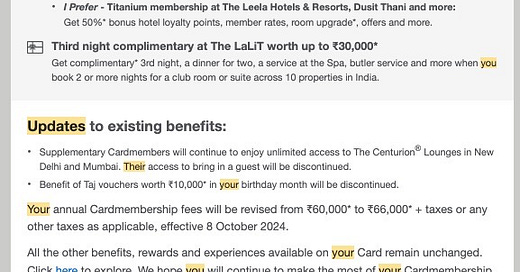

The Platinum Charge Card is the top-end Luxury Credit Card by American Express which just saw a fee increase from Rs.60,000 + taxes to Rs.66,000 + taxes. There were also some tweaks to the program, some benefits removed, and others added - lets dive deeper -

Amex Platinum Charge Card Changes -

Let’s break this down -

Pros -

Accor Plus Traveller Membership Added - (Worth Rs.11,800)

15+ Complimentary Memberships added (most aren’t great but I do think the Hotstar, Lions-gate, Sony Liv, Mint, and a few others have value, I would give this maybe Rs.3,000 of value).

Apple products via the Amex card are conditionally good, the Rs.8,000 benefit and 5x reward multipliers do have merit, but I wouldn’t add any specific value towards this.

The Lalit is one of my favorite hotels in Goa, a complimentary third night, the dinner and spa service sounds like a great deal, and is worth it, but it’s such a niche conditional offer, that will probably get disregarded or forgotten by many. I will be using this perk, but Amex could’ve definitely done a better job on curating better benefits. (You don’t club discounts on Oberoi and discounts on Lalit on the same card, both are honestly very different clientele).

Overall value gained - Maybe around Rs.15,000

Cons -

The Rs.10,000 Birthday voucher has been removed.

Add-on guests for supplementary card holders has been removed (understandable).

Fee hike by Rs.6,000.

Renewal benefit on spending 20L in the preceding year. Taj or Postcard Hotels vouchers don’t seem very attractive, however a Reliance brand voucher might be worth it, and the Rs.35,000 will pay for at least half the renewal cost.

👉🏼 If you were someone who was mindlessly renewing their card without any benefits, this is a HUGE bonus for you.

👉🏼 If you are someone who spends 20L+ and aren’t sure about renewing your card, the voucher will pay for half the renewal cost, and maybe you can further negotiate with Amex and get some additional perks.

👉🏼 If you don’t spend 20L a year on this card, renewing this card probably isn’t a good idea.

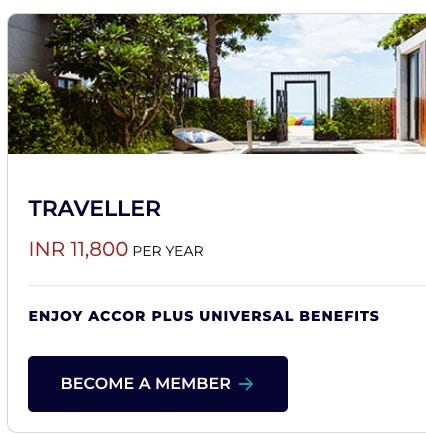

Is the Accor Plus Membership Even worth it? -

The short answer is YES! I’ve used it for a year and absolutely loved the discounts. I got multiple vouchers that I used

👉🏼 Went thrice to Gada la Vida at Novotel Juhu and got 50% off on Food. (Easily saved Rs.4,000 here)

👉🏼 Used my free Buffet voucher at Sofitel Mumbai’s Pondicherry Cafe (Saved Rs.4,000 here)

👉🏼 Got 50% off on food at a few Accor hotels during my trip to Thailand (Saved Rs.5000)

👉🏼 Stayed at the Grand Mercure in Mysuru for 2 nights at Rs.5,000 with the voucher (Standard price was Rs.11,000 for 2 nights, so saved Rs.6,000)

👉🏼 Used the 1+1 Spa voucher at Novotel Airport Hotel in Mumbai (Saved Rs.4,000)

Got a Red-hot-room at Rs.2,800 at Mercure in Goa during the off season, normally priced at Rs.8,000. (Saving Rs.5,000)

Total saved - Rs.28,000

Used it for other things too, but I can’t remember the few other places that I used the Accor Plus Membership.

The Traveller Membership costs Rs.11,8000 but you can pay in points and they sometimes have discounts, I think I paid around Rs.7,000 for it last year.

Overall Verdict - IS IT WORTH IT?

Overall, it’s not a bad option to try this card for the first year since most of the benefits make it still pretty valuable, but if you’re looking for a very black & white answer -

If you’re looking for non-tangible benefits, a stress free credit card with easy to accumulate point options, and great service, and can spend more than 20L a year, this card is definitely for you. Definitely get it.

If you’re someone who is specifically looking to make effective returns on this card, this card might be something you can opt to try for year 1, and see if you’re getting enough benefits out of it (it’ll make your other Amex cards free + you can leverage the reward xcelerators heavily). Try it for a year.

If you don’t spend 20L a year, this card isn’t for you. You’re better off getting an Amex Platinum Travel Credit card for now. Don’t get it.

Please use the link here to apply and feel free to DM me on Instagram here if you have any more questions on how to optimize the usage of this card! :)

*American Express Credit Cards*

The Platinum Card

https://www.americanexpress.com/in/credit-cards/the-platinum-card/

American Express®️ Gold Card

https://www.americanexpress.com/in/credit-cards/gold-card/

American Express®️ Membership Rewards Credit Card

https://www.americanexpress.com/in/credit-cards/membership-rewards-credit-card/

American Express®️ SmartEarn™️ Credit Card

https://www.americanexpress.com/in/credit-cards/smartearn-credit-card/

American Express®️ Platinum Travel Credit Card

https://www.americanexpress.com/in/credit-cards/platinum-travel-credit-card/

American Express®️ Platinum Reserve Credit Card

https://www.americanexpress.com/in/credit-cards/platinum-reserve-credit-card/

Great insight! Even with the price hike, these new benefits are amazing. The Lalit's offer is a gem for sure where complimentary third night paired with dinner and spa services really enhances the experience, especially for a special getaway. I completely agree that while some offers have real value, others feel a bit limited. The Accor Plus Traveller Membership is a fantastic addition, especially for frequent travelers, and the complimentary memberships do add a nice touch.